Main Vertical Constraints

Legal and Regulatory Framework

Of the 190 economies surveyed in Women, Business, and the Law (World Bank Group 2020e), 90 percent have at least one law impeding women’s economic opportunities. Restrictive legal and regulatory frameworks can render more difficult the sometimes already difficult processes of registering a business, opening a bank account, or working without the permission of a husband or male family member. Restrictive frameworks can also increase barriers to ownership, access, and control of assets such as land, housing, finance, insurance, and technology. Asset ownership is a critical means of generating income and facilitating access to credit.

Access to Finance

Women continue to be less likely than men to have access to financial institutions or to possess a bank account. In spite of recent rapid increases in financial services between 2014 and 2017 — men’s bank account ownership in developing countries increased from 60 percent to 67 percent, while women’s ownership grew from 51 percent to 59 percent (Global Findex 2017) — the gender gap has stubbornly remained at 9 percentage points in emerging markets since 2011 (Global Findex 2017).

Female-owned businesses account for 33 percent of the total SME finance gap, defined as the difference between the available supply and the potential demand that could be met by financial institutions (International Finance Corporation 2017). Many women entrepreneurs do not even apply for loans due to such factors as low financial literacy, risk aversion, and fear of failure (Morsy 2020).

Among those who do seek financing, lack of collateral is the most commonly cited impediment to securing a loan or credit. Women may also be subject to unfavorable banking practices, such as being charged higher interest rates and having to meet shorter repayment periods. They may also be hampered by having lower financial literacy as compared to males. As a result, women lose opportunities to invest in their businesses, create jobs, reduce poverty, and strengthen economies, and banks miss out on new clients and customers.

Training, Skills, and Information

Women entrepreneurs frequently start businesses with less schooling and work experience and with lower levels of management skills than their male counterparts possess, constraining their businesses’ growth and chances of success (Cirera and Qasim 2014). Approaches to addressing WSME skill gaps traditionally centered around a single type of intervention, such as business training workshops, but research has shown that, particularly for poor women, bundling interventions — such as skill and resource enhancements through financial management training and access to credit or savings accounts — is more effective (Buvinic, Furst-Nichols, and Courey Pryor 2013).

Furthermore, when starting a business, women often do not have access to information regarding profitable sectors, market size, and local supply and demand dynamics. Their access to networks for sharing best practices relative to a specific industry and gaining information on markets and prices may also be limited.

Analysis (Cirera and Qasim 2014) of data collected by the Global Entrepreneurship Monitor about entrepreneurs worldwide indicates that subjective perceptions about one’s own skills, the likelihood of failure, and ability to access opportunities explain a significant portion of the gender gap in entrepreneurial activity.

Women are further disadvantaged by having fewer professional connections, role models, and mentorship opportunities.

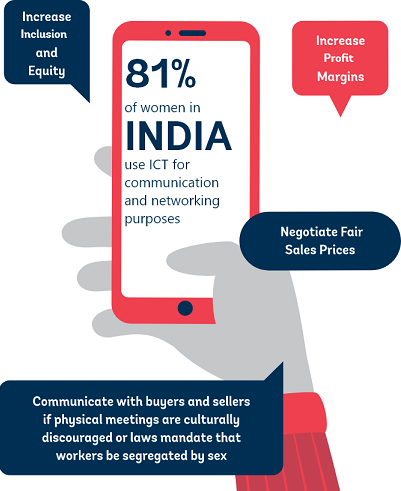

Access to Markets

Firms located far from markets face uncertainty in sourcing inputs, affecting the volume and consistency of production and limiting sales. Female entrepreneurs’ access to markets can be further constrained by social norms restricting their mobility, thereby impeding access to market information. In addition, women-owned businesses tend to be smaller, with fewer employees and lower average sales.

As a result, buyers’ volume requirements may be a barrier. Moreover, information about the type of goods in demand, quality standards, branding and presentation requirements, and pricing is not as readily accessible to women entrepreneurs, who may be unable to interact regularly with buyers.

Established buyers and sellers can engage in collusive activity that limits opportunities for new entrants to a market. In combination, these factors can severely impact women’s attempts to access new and larger markets.